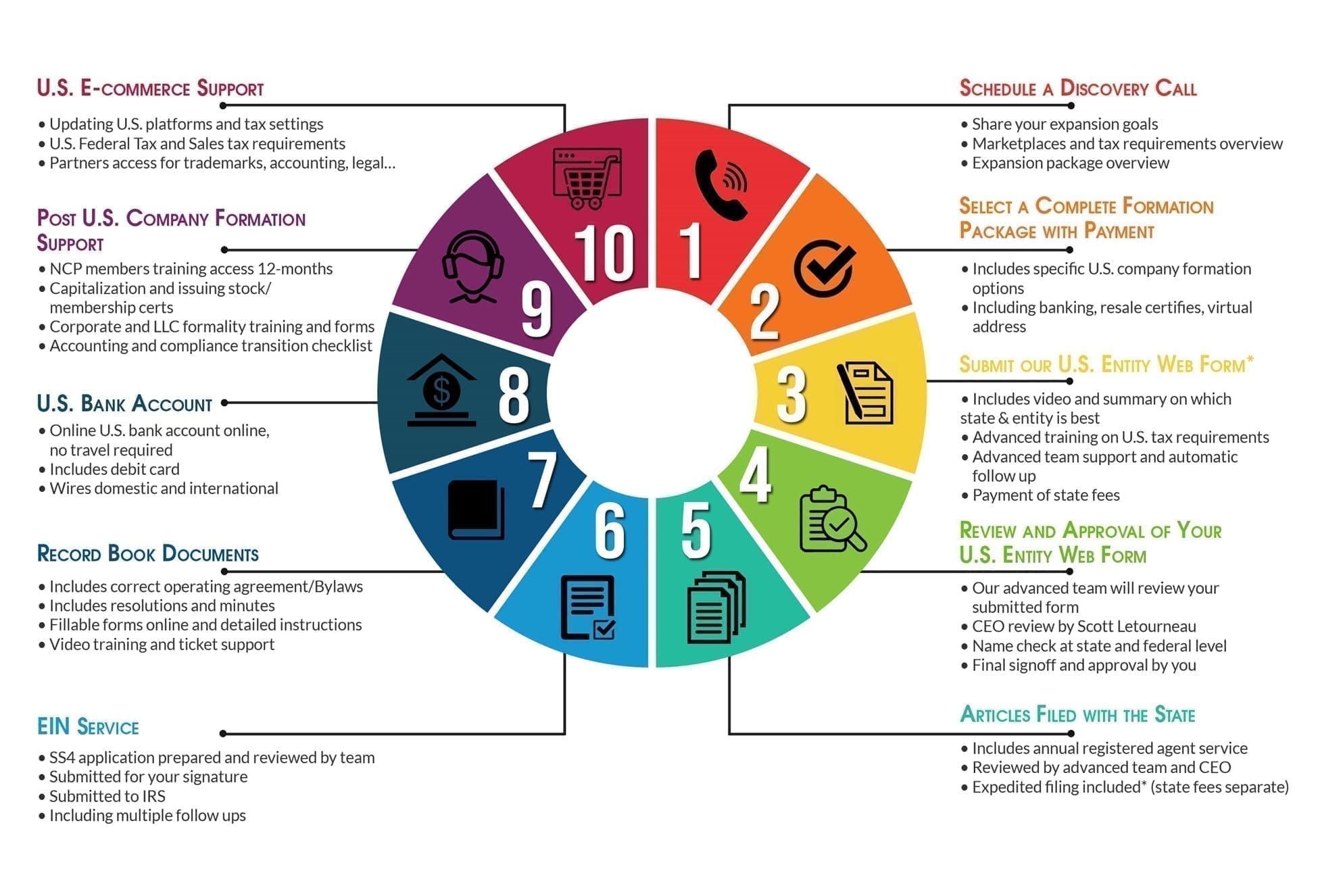

Our U.S. entity packages do not require you to know which state or entity before you get started. We have two options for support.

One (our most popular) is to schedule a 45-minute strategy call with an email summary with our CEO for $397.00 to obtain a special recommendation for your situation.

Your $397.00 investment will apply as a full credit towards our U.S. entity packages when you are ready to move forward with your formation. Learn more here about this one-on-one strategy call.

Our second option is to schedule a free call with our team, review our packages and current pricing, and select a package to get started. Go to the link at the bottom of this page to schedule your free call.

Our packages include a video training by our CEO for the most popular options, U.S. entity structure, best state and why, and what your U.S. tax return responsibilities would be with each option.

Our team will also review your submission after getting started to ensure it lines up with our SS4 application and your U.S. tax return responsibilities.