Our U.S. Entity Complete Formation Package Plans

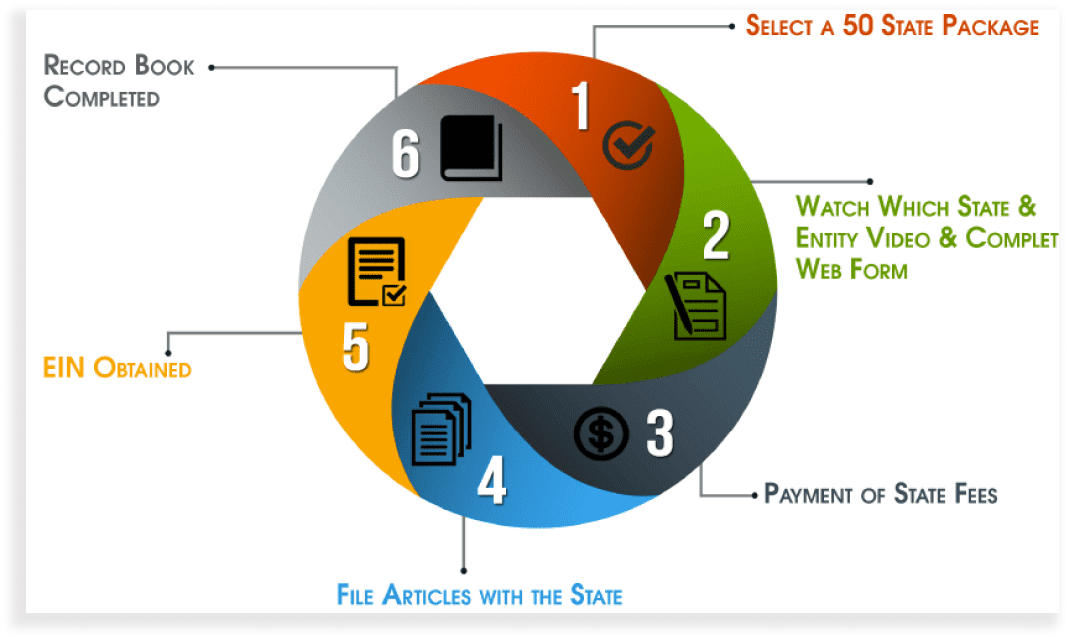

You don’t need to know which state or entity before starting with our packages. Our comprehensive video training will provide an overview and recommendations for your best state and entity.

Our goal is to provide you with clarity and confidence in these critical decision points in your LLC or corporate formation, which is included in our detailed training.

As a new client, we will simplify this complex process (as opposed to not even bringing up these points) that no one else will tackle correctly in our industry.

You don’t need to know which state or entity before starting with our packages. Our comprehensive video training will provide an overview and recommendations for your best state and entity.

You will have access to our 100 + minute video overview also covering which state and entity is best for you. Our view summary will give you the most common entity options used. Why leave the two most important decisions about your entity formation for your business startup to chance? Those are: which state and which entity are best? Why risk “guessing” on-line by clicking on a drop down menu. Our training will take you through the pluses and minuses of each entity structure and most common situations when each entity is best. You will be provided with a detailed analysis of which state is best, including liability protection to state filing fees. This video training will help you make a clear and confidence decision to move forward. Perhaps your situation is more complicated or you want a second opinion? We have paid strategies sessions available with our CEO, Scott Letourneau, or we have independent tax professionals to refer you to also (fees are separate). You will also have access to an overview of the 2018 tax law changes which are significant.

We’ll make sure your preferred business name is available in your state of incorporation and do a courtesy Federal Trademark Search. If your desired name is not available or is there is a conflict, we will contact you for alternate suggestions and keep working with you until we find a solution.

After you review your information and sign off on it we’ll make sure the articles are complete and accurate before we file the incorporating documents with the Secretary of State on your behalf. You do not have to sign any initial documents, just approve that everything is record and reply to an email.

A Registered Agent is the contact point if the entity is sued to accept service of process and forward that on to you. Our team is well trained to handle the service of process properly. NCP has a multi-step annual renewal process to make sure your company is current with the Secretary of State plus with your annual registered agent service.

In the LLC or corporate record book you will receive the correct operating agreement. If you choose an LLC that can be taxed with four different options, a disregarded entity, S or C corporation and partnership. Depending upon the taxation selection and number of members will determine the type of operating agreement. The corporation will have the correct operating agreement. You will also have access to all the minutes and resolutions in the record book online.

Businesses are required to have a Federal Tax ID Number, also called an employer identification number (EIN). With NCP’s Tax ID Obtainment Service, we will obtain your company’s EIN from the IRS once your business formation is approved by the state and you have returned via email the signed SS-4 application. The typical turn-around time for this service is 1-2 business days after we receive the required signature.

+ additional state fees

You will have access to our 100 + minute video overview also covering which state and entity is best for you. Our view summary will give you the most common entity options used. Why leave the two most important decisions about your entity formation for your business startup to chance? Those are: which state and which entity are best? Why risk “guessing” on-line by clicking on a drop down menu. Our training will take you through the pluses and minuses of each entity structure and most common situations when each entity is best. You will be provided with a detailed analysis of which state is best, including liability protection to state filing fees. This video training will help you make a clear and confidence decision to move forward. Perhaps your situation is more complicated or you want a second opinion? We have paid strategies sessions available with our CEO, Scott Letourneau, or we have independent tax professionals to refer you to also (fees are separate). You will also have access to an overview of the 2018 tax law changes which are significant.

We’ll make sure your preferred business name is available in your state of incorporation and do a courtesy Federal Trademark Search. If your desired name is not available or is there is a conflict, we will contact you for alternate suggestions and keep working with you until we find a solution.

After you review your information and sign off on it we’ll make sure the articles are complete and accurate before we file the incorporating documents with the Secretary of State on your behalf. You do not have to sign any initial documents, just approve that everything is record and reply to an email.

A Registered Agent is the contact point if the entity is sued to accept service of process and forward that on to you. Our team is well trained to handle the service of process properly. NCP has a multi-step annual renewal process to make sure your company is current with the Secretary of State plus with your annual registered agent service.

In the LLC or corporate record book you will receive the correct operating agreement. If you choose an LLC that can be taxed with four different options, a disregarded entity, S or C corporation and partnership. Depending upon the taxation selection and number of members will determine the type of operating agreement. The corporation will have the correct operating agreement. You will also have access to all the minutes and resolutions in the record book online.

You have access to our newly updated video online training on every part of your record book with simple step-by-step instructions. Includes training on an initial list (when required), initial minutes and meetings, bylaws, operating agreement (matching how many members and taxation type of the LLC), stock ledger and certificates, 2553 and 8832 when required... to help you with a COMPLETE FORMATION. Questions on any part of your record book? See our simple, step-by-step videos. Need more support; support@launchwithconfidence.com

Businesses are required to have a Federal Tax ID Number, also called an employer identification number (EIN). With NCP’s Tax ID Obtainment Service, we will obtain your company’s EIN from the IRS once your business formation is approved by the state and you have returned via email the signed SS-4 application. The typical turn-around time for this service is 1-2 business days after we receive the required signature.

An LLC or corporation that is going to be taxed as an S corporation must file form 2553 to the IRS within 75 days the company first had shareholders, started business or have capitalization. NCP will send you the form to sign and send back for original signature and send it to the IRS certified mail. If the LLC is going to be taxed as a regular corporation form 8832 is required to be filed and NCP will process that in the same manor as the 2553.

NCP will ship your LLC/Corporate record book to you with the filed articles once we receive those back from the secretary of state for two day delivery via the USPO.

+ additional state fees

You will have access to our 100 + minute video overview also covering which state and entity is best for you. Our view summary will give you the most common entity options used. Why leave the two most important decisions about your entity formation for your business startup to chance? Those are: which state and which entity are best? Why risk “guessing” on-line by clicking on a drop down menu. Our training will take you through the pluses and minuses of each entity structure and most common situations when each entity is best. You will be provided with a detailed analysis of which state is best, including liability protection to state filing fees. This video training will help you make a clear and confidence decision to move forward. Perhaps your situation is more complicated or you want a second opinion? We have paid strategies sessions available with our CEO, Scott Letourneau, or we have independent tax professionals to refer you to also (fees are separate). You will also have access to an overview of the 2018 tax law changes which are significant.

We’ll make sure your preferred business name is available in your state of incorporation and do a courtesy Federal Trademark Search. If your desired name is not available or is there is a conflict, we will contact you for alternate suggestions and keep working with you until we find a solution.

After you review your information and sign off on it we’ll make sure the articles are complete and accurate before we file the incorporating documents with the Secretary of State on your behalf. You do not have to sign any initial documents, just approve that everything is record and reply to an email.

A Registered Agent is the contact point if the entity is sued to accept service of process and forward that on to you. Our team is well trained to handle the service of process properly. NCP has a multi-step annual renewal process to make sure your company is current with the Secretary of State plus with your annual registered agent service.

In the LLC or corporate record book you will receive the correct operating agreement. If you choose an LLC that can be taxed with four different options, a disregarded entity, S or C corporation and partnership. Depending upon the taxation selection and number of members will determine the type of operating agreement. The corporation will have the correct operating agreement. You will also have access to all the minutes and resolutions in the record book online.

You have access to our newly updated video online training on every part of your record book with simple step-by-step instructions. Includes training on an initial list (when required), initial minutes and meetings, bylaws, operating agreement (matching how many members and taxation type of the LLC), stock ledger and certificates, 2553 and 8832 when required... to help you with a COMPLETE FORMATION. Questions on any part of your record book? See our simple, step-by-step videos. Need more support; support@launchwithconfidence.com

Businesses are required to have a Federal Tax ID Number, also called an employer identification number (EIN). With NCP’s Tax ID Obtainment Service, we will obtain your company’s EIN from the IRS once your business formation is approved by the state and you have returned via email the signed SS-4 application. The typical turn-around time for this service is 1-2 business days after we receive the required signature.

An LLC or corporation that is going to be taxed as an S corporation must file form 2553 to the IRS within 75 days the company first had shareholders, started business or have capitalization. NCP will send you the form to sign and send back for original signature and send it to the IRS certified mail. If the LLC is going to be taxed as a regular corporation form 8832 is required to be filed and NCP will process that in the same manor as the 2553.

NCP will ship your LLC/Corporate record book to you with the filed articles once we receive those back from the secretary of state for two day delivery via the USPO.

They depend upon entity type and state. Example: NV State Filings Fees for an LLC; $425.

Wyoming is $100. In the U.S., if you live in a state other than Nevada or Wyoming, that means you have nexus and would need to foreign register/qualify in your home state. Some state has additional fees.

For example, California has an $800 franchise tax fee for LLC the first year but waived for corporations unless they meet the minimum franchise tax fee based upon profits.

If you form an entity in one state and have nexus (physical presence) in another state, our services to foreign register the entity, and those foreign registration fees to the state are separate. Learn more.

The fee ranges from $125 to $200. Nevada is $200 and includes filing your annual report and follow up. Learn more here.

Examples; Nevada LLC is $350, Wyoming is $52.

The most common is the 1120S for an S corporation, 1120 for a C corporation, and a 1065 federal tax return for a partnership tax returns.

State tax returns are also required in most states. We will refer you to our tax partners for a quote and send you email reminders for your annual tax returns.

Learn more about all the steps involved with our 6 Steps Complete Formation at this link.

Ordering FAQs

After step 2 below when you submit your web form with your type of entity and state. This will determine your state fees and our team will send you a separate email for payment.

The good news is you don’t need to know which state and type of entity before you start with NCP. Our video training will help guide you through your best options.

We will authorize the minimum amount of stock for each state. Some states have a higher filing fee based upon the number of shares and par value. Nevada for example, at 75,000 shares at no par value equates to a $75 state filing fee, their lowest level.

If you have a special request for more stock to be authorized and a different par value, we will send you a separate price quote before we file your corporation.

Our U.S. resident packages do not require you to know which state or entity before you get started. We have two options for support.

One (our most popular) is to schedule a 30 or 45-minute strategy call with an email summary with our CEO for $297.00-$397.00 to obtain a special recommendation for your situation.

Your $297.00 or $397.00 investment will apply as a full credit towards our U.S. resident packages, starting from $395 to $495 when you are ready to move forward with your formation. Learn more here about our popular one-on-one strategy call.

Our second option is to schedule a free call with our team, review our packages and current pricing, and select a package to get started. Go to the link at the bottom of this page to schedule your free call.

Our packages include a video training by our CEO for the most popular options, U.S. entity structure, best state and why, and what your U.S. tax return responsibilities would be with each option.

Our team will also review your submission after getting started to ensure it aligns with our SS4 application and your U.S. tax return responsibilities.

The time to file your LLC or Corporation will depend upon two factors; first, which state, and second, how fast you provide us the information on our step 2 & 3 of our process.

Some states like Nevada can be filed within 24 hours of steps 2 & 3 being completed; others like California may take up to 2-3 weeks. States to have expedited options in most cases, if necessary.

Our training does cover if you form an entity in one state and need to foreign qualify in another state.

After you submit payment, you will go to our thank you page to our next steps link to complete our web form. This link includes our special training and tips on which state and entity is best.

If you miss the link on the thank you page, we also send you a welcome email with the same link to get started.

Please check your junk folder for an email from support@launchwithconfidence.com if you don’t see the welcome email within 10-15 minutes of payment. Your payment will show our main brand, Nevada Corporate Planners, Inc. (NCP) on your receipt.

Compare us to other online LLC or Corporate formation companies is like comparing starting a hobby vs. a business. The other online companies will help you file the articles and obtain an EIN, which provides ZERO PROTECTION, but it may help you set up a bank account.

At NCP, we only start with COMPLETE FORMATIONS that will protect you not only in day one but on day 10, 20, 50… in your business.

If you are looking for a company with a long track record (23 years) who works and hire experts behind the scenes to solve tax issues that you don’t even know about, you are at the right place.

It is important to note, we have had to clean up a lot of “basic filings,” and our tax partners had to deal with years of IRS issues for these clients, which ended up costing them 10X what they paid for the “basic LLC” formation.

Our team is highly training on complex issues from U.S. sales tax compliance to taxation and entity strategies. We use Zendesk for your e-mails (tickets) and our team will respond to your questions, queries, and needs very quickly. Each order is carefully evaluated before filings.

This is not a mill that pumps out LLC filings without any review. One on one strategy sessions with our CEO is available also. Learn more here.

Our checklist is vital to keep you on track. You will be guided with important steps, including capitalization, banking, business credit, partners, bookkeeping, and much more.

Our exclusive membership includes steps to help you with completing your entity record book, including completing your operating agreement, issuing membership interests or stock certificates, minutes of meetings and resolutions, capitalization, protecting IP, immigration, U.S. tax laws, and so much more.

You will receive timely updates throughout the year for your U.S. tax responsibilities, sales tax changes, or other important deadlines to keep you in compliance.

Sales tax is a contact moving target that we are on top of for you.

STS is partnered with the best of the best in the areas of taxation, sales tax, bookkeeping, tax treaties, trademarks, legal, and much more.

Need a resource? Let us know, and, as our client, we will provide an introduction.

Learn the steps to determine which state and which entity is best when you are a U.S. resident.

Our support team, along with our 100-minute U.S. resident formation video and best state and entity summary, will simplify the process.

Since 1997 Nevada Corporate Planners (NCP)*, our main brand, has helped thousands of business owners and entrepreneurs launch their business with confidence. As a client, you will have access to our vetted professional resources. NCP* is your U.S. one-stop resource for launch your U.S. company.